Why Malaysia Is Set to Lead Carbon Capture and Storage in Southeast Asia

Did you know Malaysia’s offshore sedimentary basins hold an estimated 84,114 billion tonnes of CO₂ storage capacity, more than enough to offset regional emissions for decades? (ResearchGate, 2019). With this geological advantage and its strategic positioning, Malaysia is well-positioned to become Southeast Asia’s leader in Carbon Capture and Storage (CCS).

Malaysia’s CCS Advantages

- Massive Offshore Storage: Large saline aquifers offer secure, long-term CO₂ containment.

- Proximity to Emitters: Industrial zones like Johor and Penang are close to potential storage sites, reducing transport costs and improving project economics.

- Regional Hub Potential: Located centrally in Southeast Asia, Malaysia can serve as a CCS provider for neighboring nations like Singapore and Indonesia.

Global Insights: Learning from Canada

- Shared CCS Infrastructure: Canada’s model of connecting emitters to storage through shared pipelines (e.g., Alberta Carbon Trunk Line) can inspire Malaysia’s industrial corridor strategies.

- Economic Incentives: Incentivization via tax credits and carbon pricing has driven Canada’s private-sector investment, an approach Malaysia could emulate.

- Public-Private Partnerships: Collaborations, such as Canada’s Quest project, highlight the power of aligning government and industry to scale CCS.

Accelerating Momentum in Malaysia

Government and industry are moving fast: Malaysia’s National Energy Transition Roadmap plans for 15 Mtpa CO₂ storage by 2030, escalating to 40 Mtpa by 2040, and 80 Mtpa by 2050. Petronas’s Kasawari CCS project, set to become one of the world’s largest offshore CCS initiatives, aims to store approximately 3.3 million tonnes of CO₂ annually, marking a significant milestone for Malaysia’s CCS ambitions. Meanwhile, Petronas has partnered with ADNOC and Storegga on offshore CCS initiatives targeting significant CO₂ reductions (Reuters, 2024).

By leveraging its natural strengths and global best practices, Malaysia has a real opportunity not just to lead Southeast Asia in CCS, but also to set a global example in effective decarbonization.

Cross-Border CCS Strategy: Japan to Malaysia

What’s happening?

Petronas, in collaboration with major players like Mitsui, JERA, and TotalEnergies, is developing cross-border CO₂ transport infrastructure, capturing CO₂ emissions in Japan, then shipping it to offshore Malaysian reservoirs (e.g., the M1, Penyu, and Lang Lebah basins) for long-term storage.

This builds a regional CCS value chain, with Malaysia as the storage hub for emissions-heavy economies like Japan and South Korea that lack sufficient domestic storage options.

📌 Interested in accelerating your CCS initiatives? Contact us for a demo of bMark™ and explore how we can support your carbon capture journey.

#CCS #EnergyTransition #Malaysia #SoutheastAsia #Decarbonization

The bMark™ Advantage

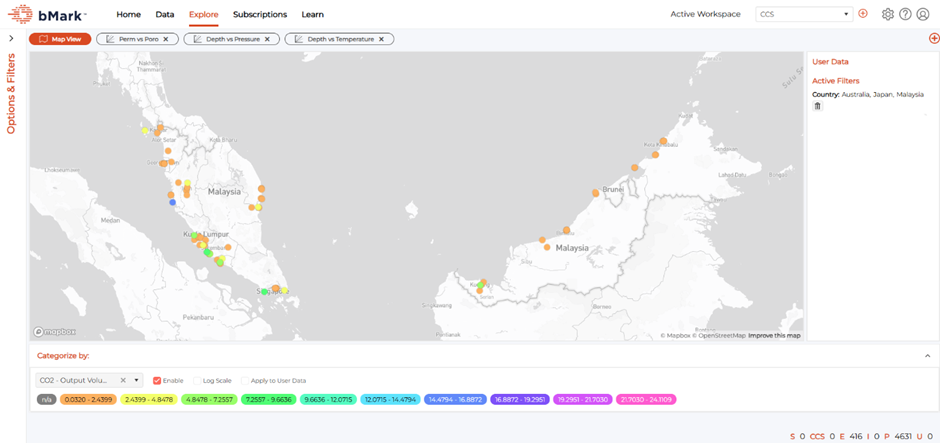

Implementing CCS at scale demands precise, data-driven insight. Belltree’s bMark™ platform is designed to:

- Storage Capacity Assessment & Site Optimization

bMark™ integrates subsurface geological data with global benchmarking techniques to assess storage capacity and identify the most technically and economically viable injection sites. The result is a clear, risk-calibrated view of where CCS can be deployed with confidence. - Emissions Mapping Around Industrial Clusters

Using advanced geospatial and emissions data, bMark™ pinpoints high-concentration CO₂ sources around major industrial hubs. This allows stakeholders to prioritize infrastructure development and cluster-based CCS networks where impact and efficiency will be greatest. - Value Chain Optimization for Operational Efficiency

The platform models entire CCS value chains, from capture to transport to injection, providing visibility into logistics, emissions reduction potential, and scalability. By simulating various configurations, bMark™ helps minimize costs and maximize throughput, ensuring projects are both bankable and future-proof.